Well, it’s that time of year again; time to purchase my annual copy of Fortune Magazine, the one with the 2009 Fortune 500 list (Volume 161, Number 6, dated 3 May 2010, to be precise, Captain…)

I guess I’m just a sucker for numbers, statistics and analysis…

Anyway, no huge surprise at the top end of The List; Wal-Mart is once again #1, with a tad over $408 Billion in revenue. Exxon-Mobil is a bit of a distant second, with only $284 Billion… and believe me, I see the irony of using the term “only” to describe almost “three hundred billion dollars…”

There are 16 companies in the “$100 Billion Plus” club this year, with American International Group making some very impressive gains; moving from 245th spot on last year’s list to #16 this year; that’s an amazing 829% increase of gross revenue…

But, to be honest, I’m much more interested in seeing how my favourite company has done. And they did well; Apple placed in the 56th spot. That’s the best Apple has ever done, since their debut on the 1982 list, at 411th. It was also quite a jump from last year, when they placed 71st, and even a significant improvement from their previous record of 67th way back in 1993.

The record placing on the list was obviously due to their record breaking revenue in 2009; $36,537 Million… Thirty Six and a half Billion dollars…

Hrm… wait a minute… according to my records (yes, I know; me having “records” of Apple’s financial results is more than a little geeky), Apple’s revenue last year was $41,508 Million… but the Fortune 500 list clearly says $36,537 Million. That’s a difference of $4,971 Million. Not exactly chump change. Where did it come from? I highly doubt Steve Jobs found it in the couch cushions one day…

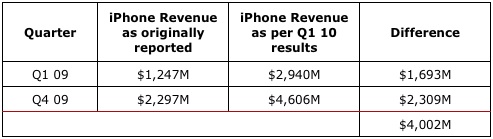

Oh, of course; as I mentioned in a previous blog post (on 26 Jan), Apple has been revising how they account for iPhone revenue. That made for an “extra” $900 Million in Q2, $1,693 Million in Q1, and a whopping $2,309 Million in Q4… and we still don’t have the revised numbers for Q3; those won’t be released until early July.

So, if we take in to account their revised revenue (at least for the three quarters we know about), where would they have been on the Fortune 500 list? Well, it looks like they’d be a very comfortable 51st place (just behind #50 Pepsico, who had $43,232 Million of revenue).

And, if Apple’s revised Q3 numbers are high enough, they might even edge out that acclaimed purveyor of sugared water to claim 50th spot… at least “theoretically,” since the official Fortune 500 List uses their previously announced “official” revenue claims, rather than the ones that result from their revised accounting. And to be honest, that only makes sense. But… it’s nice to think about. I had theorized that Apple could break into the Top 50 of this year’s List; even though they did not, officially, it’s cool that they might, even if only theoretically.

Of course, when the Q3 numbers are released, I’ll be sure to let everyone know how it turned out… that’s just the numbers and statistics obsessed geek kind of guy I am.

Cheers!