Yesterday, Apple released its fiscal results from the first quarter of fiscal year 2010. And it was a great quarter; over $15 Billion in revenue… their best quarter ever, as a matter of fact. As you may remember from a previous blog entry, the first fiscal quarter corresponds to the holiday season of the previous calendar year, and Apple traditionally does well during that Holiday shopping spree we all know and love, so big numbers should not be a huge surprise to anyone. Even less of a surprise is that I am now blogging about those results. That’s just the kind of guy I am.

Now, in that blog post on Apple fiscal results, I showed data compiled over the last several years. This data comes from the Data Sums that Apple posts with their results; I have been downloading these files and putting the numbers into a big honking spreadsheet to make some pretty cool (if I say so myself) graphs for analysis. So the first cool thing about this quarter’s release was the note attached to the data sum:

In September 2009, the Financial Accounting Standards Board amended the accounting principles related to revenue recognition for arrangements with multiple deliverables and arrangements that include software elements. Apple adopted the new accounting principles on a retrospective basis during the first quarter of 2010. The new accounting principles significantly change how Apple accounts for certain revenue arrangements that include both hardware and software elements. The impact of the new accounting principles is reflected for all periods above. For additional information refer to the “Explanatory Note” in Apple’s Amendment No. 1 to the Annual Report on Form 10-K for the year ended September 26, 2009.

Now… that is interesting, and I’ll tell you why. The Data Sum that Apple releases each quarter contains not only the data for the quarter being reported, but also for the immediately previous quarter and for the year ago quarter, so you can compare how Apple is doing now to how they were doing in the past. And, as the note quoted above mentions, the changes in accounting principles were applied to the older results that are included in the Q1 2010 Data Sum. And the differences are pretty amazing.

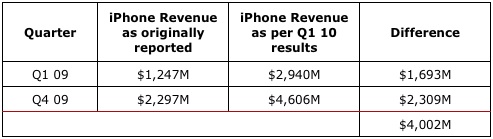

Although the note does not specify, it is obvious, when you look at the numbers, that the impact from the new accounting principles is in the revenue Apple reported related to iPhone. Check it out:

iPhone revenue, based on these new numbers, was more than twice what was originally reported under the old accounting principles. Gross revenue for the year was $4 Billion higher than originally reported, based only on the differences from those two quarters. When Apple releases the new numbers for Q2 and Q3 09, the overall increase in total annual revenue will probably be pretty amazing.

Beyond the total revenue aspect, there are a couple of other cool factoids from the Q1 10 results:

First, for both this quarter and the (new) previous quarter, iPhone revenue was greater than CPU revenue. Which kind of takes the wind out of my sails; in the blog post linked to above, I argued that Apple was still, primarily, a computer company and it was computers, not iPods, that drove Apple’s revenue machine. That no longer seems to be the case. You could argue, I guess, that the iPhone is, in many ways, a handheld computer, but the fact that Apple themselves report iPhone revenue as separate from CPU revenue kind of makes the point. And the new device to be announced by Apple tomorrow may just add even more fuel to that fire.

The second cool factoid is that the total revenue for Q4 09 is now higher than for Q1 09. Remember how I said that Q1 revenue is always high, due to Christmas sales? That trend has been very evident in Apple’s results for the past five or six years, with a plausible explanation being iPods making such great Christmas gifts, and it showed in the “sawtooth” graphs I showed in my Charting Apple post. Well, at first glance, it appears that iPhone sales (which I postulated earlier might be stealing iPod sales) are causing Apple’s quarterly revenue to be more even, less influenced by Christmas sales. I am sure iPhones also make great Christmas presents, but the revenue from iPhone is less affected by the Christmas rush. Don’t forget, Apple gets a cut of the revenue from carriers. I don’t think we can make a firm conclusion at this point, based on just a couple of quarters; we’ll have to see what the “new” results for Q2 and Q3 09 are, and (naturally) the results from the rest of fiscal 2010. But rest assured, I will be blogging about them when they come out.

The other bit of neat info, not really from these fiscal results, is that Apple’s “cash on hand” and “short term investments” are around $40 Billion… which is more than enough cash to buy every single share of Dell. Not that this is actually “new” information; it’s been that way for a while; I’ve posted about it before. But it’s one of those things that is worth repeating. But who’d want to buy a washed up computer company like Dell anyway?